Ether, the second-largest currency, has plunged as much as 9% to its lowest level since September 30, 2021, comparable to Bitcoin. According to CoinGecko, both tokens, as well as Solana, Cardano, XRP, and Binance Coin, are down more than 10% in the previous week.

The drop occurred minutes after the minutes of the Federal Reserve's December meeting were published on January 5, 2022. It hinted at unanticipated rake rises as well as a potential balance-sheet breakdown.

According to Fundstrat analysts, "the primary cause of this sell-off is the Fed's intention to reduce the balance sheet in Q1 2022." Unfortunately, no immediate support appears to be in sight ahead of the September 2021 lows of $39,573, with breaches of that level continuing down to last summer's May-July bottom."

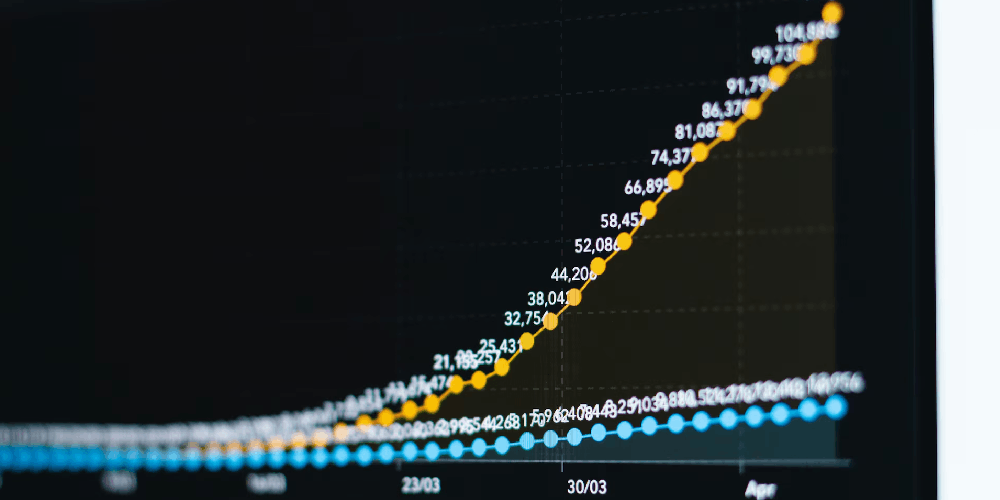

Bitcoin surged nearly 60% last year, outperforming other asset classes, but latest numbers reveal it has faltered.

"As the crypto market matures," said Ben Caselin, Head of Research and Strategy at Crypto Exchange AAX, "we can see major crypto assets such as Bitcoin and Ethereum increasingly move in tandem with traditional markets including Treasury bonds."

Antoni Trenchev, Co-founder of Crypto lender Nexo, warned that a breakdown of Bitcoin's price below $41,000 "could get ugly, with the mid-to-low thirties a possible destination," adding that Bitcoin had a two-month phase of stabilisation between May and July last year.

"A repeat of history can't be ruled out as Fed tightening remains the popular narrative," he said.