That'record' is obviously nothing to be proud of, as the regulator ordered William Hill, which is controlled by 888 Holdings, to pay £19.2 million ($23.6 million) for "alarming" and "widespread" social responsibility and anti-money laundering shortcomings.

The prior regulatory settlement for Entain was for £17 million, which isn't really a fine.

William Hill, on the other hand, was anticipating learning how much it would have to pay after three of its firms were found to have committed the errors.

In fact, William Hill Organisation Limited owes £3 million, Mr. Green Limited will receive £3.7 million, and WHG (International) Limited will pay £12.5 million.

When parent firm 888 was contacted by Gambling Insider for comment, it gave the following response: "The settlement pertains to the time when William Hill was under the former ownership and management. Following the acquisition of William Hill, the business swiftly addressed the problems by putting a thorough action plan into place.

"The entire Group shares the GC's commitment to improve compliance standards across the industry, and we will continue to work collaboratively with the regulator and other stakeholders to achieve this."

Even while the operator emphasises that these mistakes were made before to 888's acquisition of William Hill in 2022, these additional regulatory problems won't help to stabilise parent firm 888's share price.

Since the abrupt resignation of longtime corporate leader and CEO Itai Pazner, it has already seen a dramatic deterioration.

888 was revealed to have made severe mistakes with VIP players in the Middle East at the time of that announcement. These corporate-wide issues have now spread to the UK market, but with a predetermined resolution.

The share price of 888 increased to about £0.65 last week, but it has now dropped to £0.53, as it was expected to do on the morning of the Gambling Commission's statement.

Consideration is taken to suspending licences.

There will be some closure now that the finer points have been made, if you'll pardon the pun, as well as possibly a tiny degree of happiness that the settlement sum was not larger.

Because it might have been worse, according to Andrew Rhodes, chief executive of the Gambling Commission: "Serious consideration was given to suspending the licence because the breaches we identified were so pervasive and frightening when we commenced this inquiry.

But because the operator acknowledged their mistakes right away and cooperated with us to put fixes in place right away, "we instead chose to fork over the largest enforcement payment in our history."

As with the warning about Entain, all cautions about licence suspension must be treated with caution.

As regulatory tales in Australia have demonstrated (nine-figure penalties have allowed licences to remain in operation), the likelihood that the Gambling Commission will really revoke the licence of such a large operator is another matter together.

The regulatory violations by William Hill itself were the result of recent Gambling Commission fines that have become standard practise.

One new client, for instance, was permitted to "spend" $23,000 in the first 20 minutes of creating an account (without being subjected to any responsible gambling screenings).

331 players who had self-excluded were nevertheless able to place bets with Mr. Green, demonstrating the "ineffective controls" that were un place.

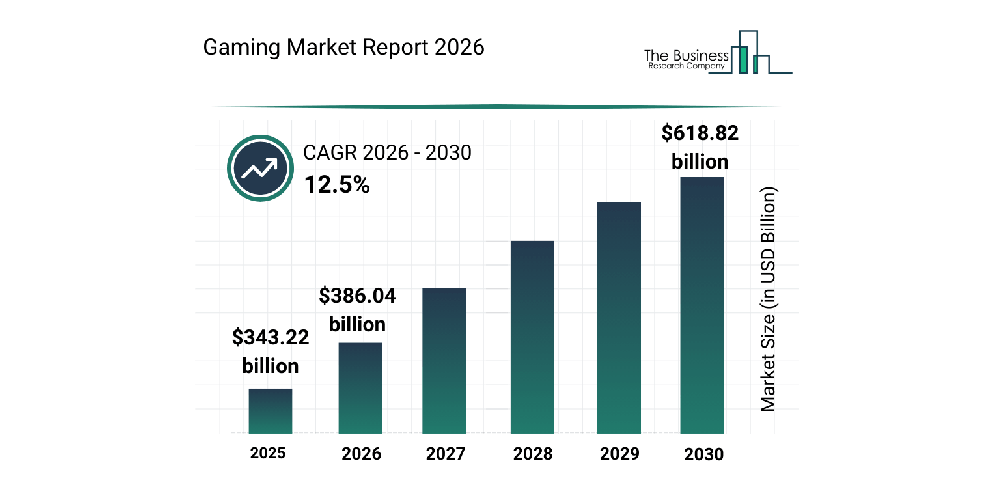

There is still great opportunity for development in the industry.

There was a lot more discovered, and this is once more the ultimate juxtaposition of the gaming industry.

Tier-one operators are under pressure from shareholders who want to maximise their quarterly returns on investment, despite the fact that they must do all possible to promote responsible gaming.

All things considered, the industry still has a ways to go in the engine room. And William Hill, who previously had the unwelcome record for the UK, has dethroned Entain and is now in the lead.